Time Series Analysis - VAR Models

VAR Model

import numpy as np

import pandas as pd

%matplotlib inline

from statsmodels.tsa.api import VAR

from statsmodels.tsa.stattools import adfuller

from statsmodels.tools.eval_measures import rmse

import warnings

warnings.filterwarnings('ignore')

df = pd.read_csv('Data/M2SLMoneyStock.csv', index_col=0, parse_dates=True)

df.index.freq = 'MS'

sp = pd.read_csv('Data/PCEPersonalSpending.csv', index_col=0, parse_dates=True)

sp.index.freq = 'MS'

df.head()

| Money | |

|---|---|

| Date | |

| 1995-01-01 | 3492.4 |

| 1995-02-01 | 3489.9 |

| 1995-03-01 | 3491.1 |

| 1995-04-01 | 3499.2 |

| 1995-05-01 | 3524.2 |

sp.head()

| Spending | |

|---|---|

| Date | |

| 1995-01-01 | 4851.2 |

| 1995-02-01 | 4850.8 |

| 1995-03-01 | 4885.4 |

| 1995-04-01 | 4890.2 |

| 1995-05-01 | 4933.1 |

df = df.join(sp)

df.head()

| Money | Spending | |

|---|---|---|

| Date | ||

| 1995-01-01 | 3492.4 | 4851.2 |

| 1995-02-01 | 3489.9 | 4850.8 |

| 1995-03-01 | 3491.1 | 4885.4 |

| 1995-04-01 | 3499.2 | 4890.2 |

| 1995-05-01 | 3524.2 | 4933.1 |

df.shape

(252, 2)

df = df.dropna()

df.shape

(252, 2)

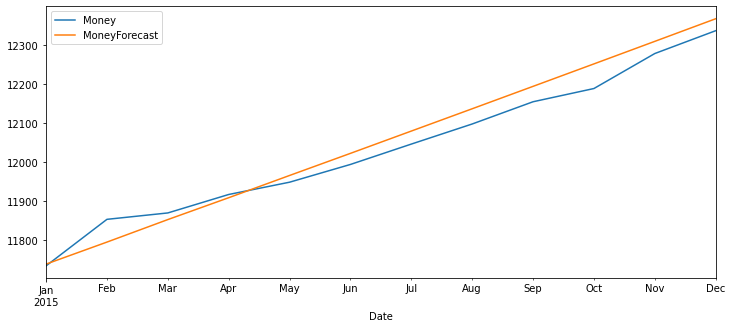

df.plot(figsize=(12,8))

<AxesSubplot:xlabel='Date'>

Differencing

def adf_test(series, title=''):

"""

Pass in a time series and an optional title, returns an ADF report

"""

print(f'Augmented Dickey-Fuller Test: {title}')

result = adfuller(series.dropna(), autolag = 'AIC')

labels = ['ADF test statistic', 'p-value', '# lags used', '# obervations']

out = pd.Series(result[0:4], index = labels)

for key, val in result[4].items():

out[f'critical value ({key})'] = val

print(out.to_string())

if result[1] <= 0.05:

print('Strong evidence against the null hypothesis')

print('Reject the null hypothesis')

print('Data has no unit root and is stationary')

else:

print('Weak evidence against the null hypothesis')

print('Fail to reject the null hypothesis')

print('Data has a unit root and is non-stationary')

adf_test(df['Money'])

Augmented Dickey-Fuller Test:

ADF test statistic 4.239022

p-value 1.000000

# lags used 4.000000

# obervations 247.000000

critical value (1%) -3.457105

critical value (5%) -2.873314

critical value (10%) -2.573044

Weak evidence against the null hypothesis

Fail to reject the null hypothesis

Data has a unit root and is non-stationary

adf_test(df['Spending'])

Augmented Dickey-Fuller Test:

ADF test statistic 0.149796

p-value 0.969301

# lags used 3.000000

# obervations 248.000000

critical value (1%) -3.456996

critical value (5%) -2.873266

critical value (10%) -2.573019

Weak evidence against the null hypothesis

Fail to reject the null hypothesis

Data has a unit root and is non-stationary

df_transformed = df.diff()

print(adf_test(df_transformed['Money']))

print(adf_test(df_transformed['Spending']))

Augmented Dickey-Fuller Test:

ADF test statistic -2.057404

p-value 0.261984

# lags used 15.000000

# obervations 235.000000

critical value (1%) -3.458487

critical value (5%) -2.873919

critical value (10%) -2.573367

Weak evidence against the null hypothesis

Fail to reject the null hypothesis

Data has a unit root and is non-stationary

None

Augmented Dickey-Fuller Test:

ADF test statistic -7.226974e+00

p-value 2.041027e-10

# lags used 2.000000e+00

# obervations 2.480000e+02

critical value (1%) -3.456996e+00

critical value (5%) -2.873266e+00

critical value (10%) -2.573019e+00

Strong evidence against the null hypothesis

Reject the null hypothesis

Data has no unit root and is stationary

None

df_transformed = df_transformed.diff().dropna()

df_transformed

| Money | Spending | |

|---|---|---|

| Date | ||

| 1995-03-01 | 3.7 | 35.0 |

| 1995-04-01 | 6.9 | -29.8 |

| 1995-05-01 | 16.9 | 38.1 |

| 1995-06-01 | -0.3 | 1.5 |

| 1995-07-01 | -6.2 | -51.7 |

| ... | ... | ... |

| 2015-08-01 | -0.7 | -8.5 |

| 2015-09-01 | 5.5 | -39.8 |

| 2015-10-01 | -23.1 | 24.5 |

| 2015-11-01 | 55.8 | 10.7 |

| 2015-12-01 | -31.2 | -15.0 |

250 rows × 2 columns

print(adf_test(df_transformed['Money']))

print(adf_test(df_transformed['Spending']))

Augmented Dickey-Fuller Test:

ADF test statistic -7.077471e+00

p-value 4.760675e-10

# lags used 1.400000e+01

# obervations 2.350000e+02

critical value (1%) -3.458487e+00

critical value (5%) -2.873919e+00

critical value (10%) -2.573367e+00

Strong evidence against the null hypothesis

Reject the null hypothesis

Data has no unit root and is stationary

None

Augmented Dickey-Fuller Test:

ADF test statistic -8.760145e+00

p-value 2.687900e-14

# lags used 8.000000e+00

# obervations 2.410000e+02

critical value (1%) -3.457779e+00

critical value (5%) -2.873609e+00

critical value (10%) -2.573202e+00

Strong evidence against the null hypothesis

Reject the null hypothesis

Data has no unit root and is stationary

None

Train and Test Split

# Number of Obervations

nobs = 12

train = df_transformed[:-nobs]

test = df_transformed[-nobs:]

print(train.shape)

print(test.shape)

(238, 2)

(12, 2)

GRIDSEARCH FOR ORDER p AR of VAR model

model = VAR(train)

for p in [1,2,3,4,5,6,7]:

results = model.fit(p)

print(f'ORDER {p}')

print(f'AIC: {results.aic}')

print('\n')

ORDER 1

AIC: 14.178610495220896

ORDER 2

AIC: 13.955189367163703

ORDER 3

AIC: 13.849518291541038

ORDER 4

AIC: 13.827950574458283

ORDER 5

AIC: 13.78730034460964

ORDER 6

AIC: 13.799076756885809

ORDER 7

AIC: 13.797638727913972

results = model.fit(5)

results.summary()

Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Fri, 16, Oct, 2020

Time: 12:55:32

--------------------------------------------------------------------

No. of Equations: 2.00000 BIC: 14.1131

Nobs: 233.000 HQIC: 13.9187

Log likelihood: -2245.45 FPE: 972321.

AIC: 13.7873 Det(Omega_mle): 886628.

--------------------------------------------------------------------

Results for equation Money

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.516683 1.782238 0.290 0.772

L1.Money -0.646232 0.068177 -9.479 0.000

L1.Spending -0.107411 0.051388 -2.090 0.037

L2.Money -0.497482 0.077749 -6.399 0.000

L2.Spending -0.192202 0.068613 -2.801 0.005

L3.Money -0.234442 0.081004 -2.894 0.004

L3.Spending -0.178099 0.074288 -2.397 0.017

L4.Money -0.295531 0.075294 -3.925 0.000

L4.Spending -0.035564 0.069664 -0.511 0.610

L5.Money -0.162399 0.066700 -2.435 0.015

L5.Spending -0.058449 0.051357 -1.138 0.255

==============================================================================

Results for equation Spending

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.203469 2.355446 0.086 0.931

L1.Money 0.188105 0.090104 2.088 0.037

L1.Spending -0.878970 0.067916 -12.942 0.000

L2.Money 0.053017 0.102755 0.516 0.606

L2.Spending -0.625313 0.090681 -6.896 0.000

L3.Money -0.022172 0.107057 -0.207 0.836

L3.Spending -0.389041 0.098180 -3.963 0.000

L4.Money -0.170456 0.099510 -1.713 0.087

L4.Spending -0.245435 0.092069 -2.666 0.008

L5.Money -0.083165 0.088153 -0.943 0.345

L5.Spending -0.181699 0.067874 -2.677 0.007

==============================================================================

Correlation matrix of residuals

Money Spending

Money 1.000000 -0.267934

Spending -0.267934 1.000000

# Grab 5 Lagged values, right before the test starts!

# Numpy array

lagged_values = train.values[-5:]

z = results.forecast(y=lagged_values, steps = 12)

z

array([[-16.99527634, 36.14982003],

[ -3.17403756, -11.45029844],

[ -0.377725 , -6.68496939],

[ -2.60223305, 5.47945777],

[ 4.228557 , -2.44336505],

[ 1.55939341, 0.38763902],

[ -0.99841027, 3.88368011],

[ 0.36451042, -2.3561014 ],

[ -1.21062726, -1.22414652],

[ 0.22587712, 0.786927 ],

[ 1.33893884, 0.18097449],

[ -0.21858453, 0.21275046]])

test

| Money | Spending | |

|---|---|---|

| Date | ||

| 2015-01-01 | -15.5 | -26.6 |

| 2015-02-01 | 56.1 | 52.4 |

| 2015-03-01 | -102.8 | 39.5 |

| 2015-04-01 | 30.9 | -40.4 |

| 2015-05-01 | -15.8 | 38.8 |

| 2015-06-01 | 14.0 | -34.1 |

| 2015-07-01 | 6.7 | 6.9 |

| 2015-08-01 | -0.7 | -8.5 |

| 2015-09-01 | 5.5 | -39.8 |

| 2015-10-01 | -23.1 | 24.5 |

| 2015-11-01 | 55.8 | 10.7 |

| 2015-12-01 | -31.2 | -15.0 |

idx = pd.date_range('2015-01-01', periods=12, freq = 'MS')

idx

DatetimeIndex(['2015-01-01', '2015-02-01', '2015-03-01', '2015-04-01',

'2015-05-01', '2015-06-01', '2015-07-01', '2015-08-01',

'2015-09-01', '2015-10-01', '2015-11-01', '2015-12-01'],

dtype='datetime64[ns]', freq='MS')

df_forecast = pd.DataFrame(data=z, index=idx, columns=['Money_2d', 'Spending_2d'])

df_forecast

| Money_2d | Spending_2d | |

|---|---|---|

| 2015-01-01 | -16.995276 | 36.149820 |

| 2015-02-01 | -3.174038 | -11.450298 |

| 2015-03-01 | -0.377725 | -6.684969 |

| 2015-04-01 | -2.602233 | 5.479458 |

| 2015-05-01 | 4.228557 | -2.443365 |

| 2015-06-01 | 1.559393 | 0.387639 |

| 2015-07-01 | -0.998410 | 3.883680 |

| 2015-08-01 | 0.364510 | -2.356101 |

| 2015-09-01 | -1.210627 | -1.224147 |

| 2015-10-01 | 0.225877 | 0.786927 |

| 2015-11-01 | 1.338939 | 0.180974 |

| 2015-12-01 | -0.218585 | 0.212750 |

Invert the Transformation

df_forecast['Money_1d'] = (df['Money'].iloc[-nobs-1]-df['Money'].iloc[-nobs-2]) + df_forecast['Money_2d'].cumsum()

df_forecast['MoneyForecast'] = df['Money'].iloc[-nobs-1] + df_forecast['Money_1d'].cumsum()

df_forecast['Spending_1d'] = (df['Spending'].iloc[-nobs-1]-df['Spending'].iloc[-nobs-2]) + df_forecast['Spending_2d'].cumsum()

df_forecast['SpendingForecast'] = df['Spending'].iloc[-nobs-1] + df_forecast['Spending_1d'].cumsum()

df_forecast.head()

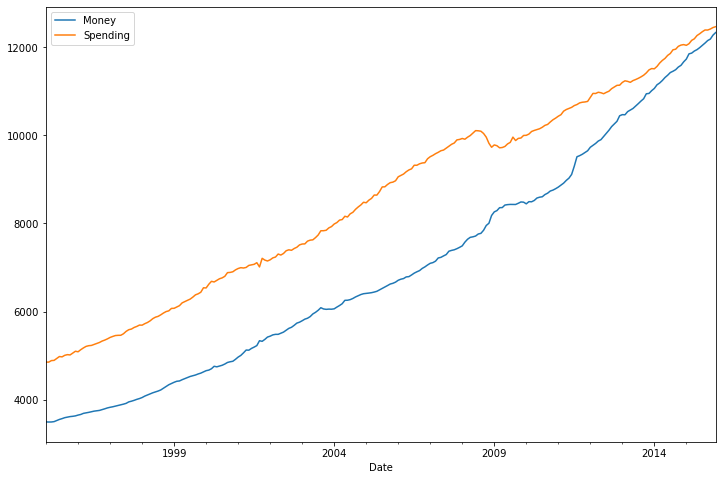

test_range = df[-nobs:]

test_range.plot(figsize = (12,8))

df_forecast[['MoneyForecast','SpendingForecast']].plot(figsize=(12,8))

<AxesSubplot:>

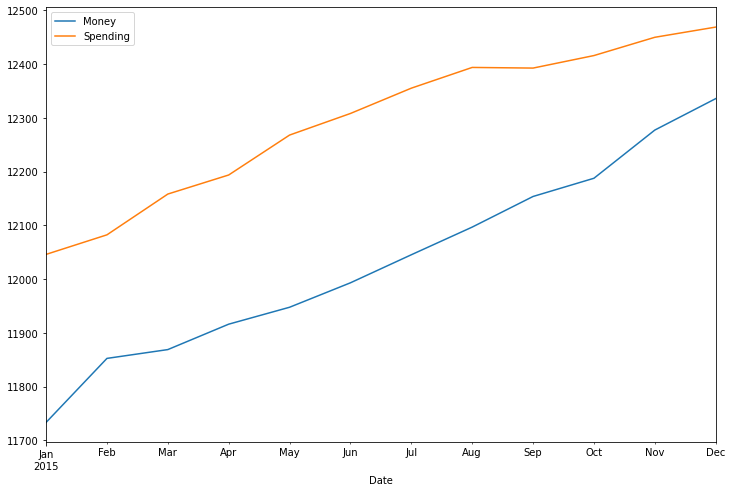

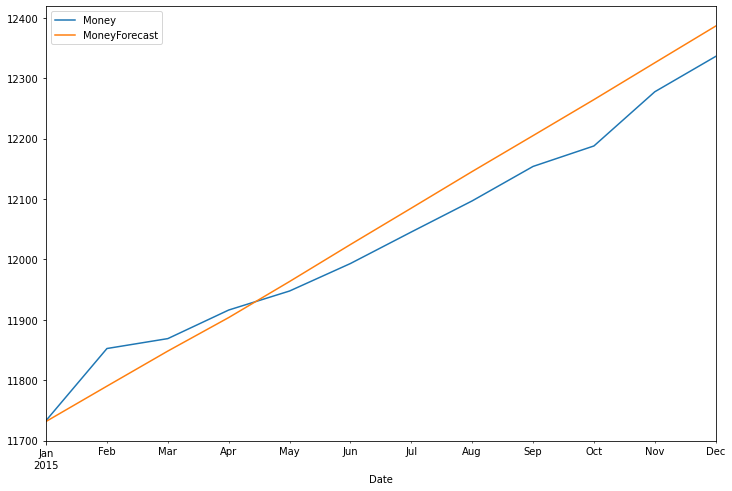

test_range['Money'].plot(legend=True, figsize=(12,8))

df_forecast['MoneyForecast'].plot(legend=True)

<AxesSubplot:xlabel='Date'>

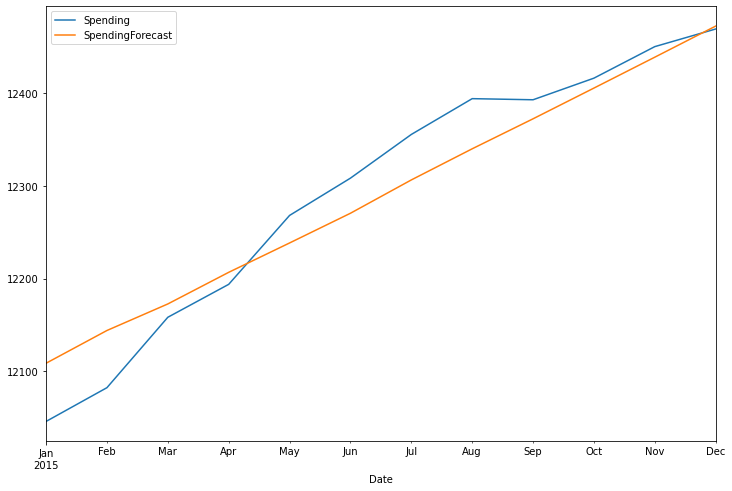

test_range['Spending'].plot(legend=True, figsize=(12,8))

df_forecast['SpendingForecast'].plot(legend=True)

<AxesSubplot:xlabel='Date'>

rmse(test_range['Money'], df_forecast['MoneyForecast'])

43.71049653558893

test_range['Money'].mean()

12034.008333333333

rmse(test_range['Spending'], df_forecast['SpendingForecast'])

37.001175169408036

test_range['Spending'].mean()

12294.533333333335

VARMA Model

import numpy as np

import pandas as pd

%matplotlib inline

from statsmodels.tsa.statespace.varmax import VARMAX, VARMAXResults

from statsmodels.tsa.stattools import adfuller

from pmdarima import auto_arima

from statsmodels.tools.eval_measures import rmse

import warnings

warnings.filterwarnings('ignore')

df = pd.read_csv('Data/M2SLMoneyStock.csv', index_col=0, parse_dates=True)

df.index.freq = 'MS'

sp = pd.read_csv('Data/PCEPersonalSpending.csv', index_col=0, parse_dates=True)

sp.index.freq = 'MS'

df = df.join(sp)

df

| Money | Spending | |

|---|---|---|

| Date | ||

| 1995-01-01 | 3492.4 | 4851.2 |

| 1995-02-01 | 3489.9 | 4850.8 |

| 1995-03-01 | 3491.1 | 4885.4 |

| 1995-04-01 | 3499.2 | 4890.2 |

| 1995-05-01 | 3524.2 | 4933.1 |

| ... | ... | ... |

| 2015-08-01 | 12096.8 | 12394.0 |

| 2015-09-01 | 12153.8 | 12392.8 |

| 2015-10-01 | 12187.7 | 12416.1 |

| 2015-11-01 | 12277.4 | 12450.1 |

| 2015-12-01 | 12335.9 | 12469.1 |

252 rows × 2 columns

auto_arima(df['Money'], maxiter=1000)

ARIMA(maxiter=1000, order=(1, 2, 1), scoring_args={}, with_intercept=False)

auto_arima(df['Spending'], maxiter = 1000)

ARIMA(maxiter=1000, order=(1, 1, 2), scoring_args={})

df_transformed = df.diff().diff()

df_transformed = df_transformed.dropna()

df_transformed.head()

| Money | Spending | |

|---|---|---|

| Date | ||

| 1995-03-01 | 3.7 | 35.0 |

| 1995-04-01 | 6.9 | -29.8 |

| 1995-05-01 | 16.9 | 38.1 |

| 1995-06-01 | -0.3 | 1.5 |

| 1995-07-01 | -6.2 | -51.7 |

len(df_transformed)

250

Train / Test Split

nobs = 12

train, test = df_transformed[0:-nobs], df_transformed[-nobs:]

print(train.shape)

print(test.shape)

(238, 2)

(12, 2)

Fit the VARMA(1,2) Model

model = VARMAX(train, order=(1,2), trend='c')

results = model.fit(maxiter = 1000, disp=False)

results.summary()

| Dep. Variable: | ['Money', 'Spending'] | No. Observations: | 238 |

|---|---|---|---|

| Model: | VARMA(1,2) | Log Likelihood | -2285.860 |

| + intercept | AIC | 4605.720 | |

| Date: | Fri, 16 Oct 2020 | BIC | 4664.749 |

| Time: | 13:32:48 | HQIC | 4629.510 |

| Sample: | 03-01-1995 | ||

| - 12-01-2014 | |||

| Covariance Type: | opg |

| Ljung-Box (Q): | 67.60, 28.85 | Jarque-Bera (JB): | 552.05, 127.75 |

|---|---|---|---|

| Prob(Q): | 0.00, 0.90 | Prob(JB): | 0.00, 0.00 |

| Heteroskedasticity (H): | 5.55, 2.87 | Skew: | 1.34, -0.32 |

| Prob(H) (two-sided): | 0.00, 0.00 | Kurtosis: | 9.96, 6.53 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 0.1643 | 0.861 | 0.191 | 0.849 | -1.523 | 1.852 |

| L1.Money | -1.1746 | 4.475 | -0.262 | 0.793 | -9.945 | 7.596 |

| L1.Spending | 2.5441 | 8.612 | 0.295 | 0.768 | -14.335 | 19.423 |

| L1.e(Money) | 0.4093 | 4.462 | 0.092 | 0.927 | -8.337 | 9.155 |

| L1.e(Spending) | -2.6706 | 8.613 | -0.310 | 0.757 | -19.553 | 14.212 |

| L2.e(Money) | -1.4619 | 4.634 | -0.315 | 0.752 | -10.544 | 7.620 |

| L2.e(Spending) | 2.3604 | 7.599 | 0.311 | 0.756 | -12.534 | 17.254 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 0.0757 | 0.070 | 1.079 | 0.281 | -0.062 | 0.213 |

| L1.Money | -0.3230 | 2.423 | -0.133 | 0.894 | -5.072 | 4.426 |

| L1.Spending | 0.8097 | 4.508 | 0.180 | 0.857 | -8.027 | 9.646 |

| L1.e(Money) | 0.4454 | 2.485 | 0.179 | 0.858 | -4.425 | 5.316 |

| L1.e(Spending) | -1.7643 | 4.485 | -0.393 | 0.694 | -10.556 | 7.027 |

| L2.e(Money) | -0.4424 | 2.579 | -0.172 | 0.864 | -5.497 | 4.613 |

| L2.e(Spending) | 0.7857 | 3.941 | 0.199 | 0.842 | -6.939 | 8.511 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| sqrt.var.Money | 25.7081 | 1.888 | 13.619 | 0.000 | 22.008 | 29.408 |

| sqrt.cov.Money.Spending | -8.7303 | 1.843 | -4.738 | 0.000 | -12.342 | -5.119 |

| sqrt.var.Spending | 33.4869 | 1.234 | 27.128 | 0.000 | 31.068 | 35.906 |

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Predict the next 12 values

df_forecast = results.forecast(12)

df_forecast

| Money | Spending | |

|---|---|---|

| 2015-01-01 | -11.050219 | 37.367991 |

| 2015-02-01 | -11.097937 | -4.699904 |

| 2015-03-01 | 1.242635 | -0.144623 |

| 2015-04-01 | -1.663244 | -0.442775 |

| 2015-05-01 | 0.991430 | 0.254518 |

| 2015-06-01 | -0.352719 | -0.038456 |

| 2015-07-01 | 0.480741 | 0.158538 |

| 2015-08-01 | 0.002947 | 0.048803 |

| 2015-09-01 | 0.284976 | 0.114297 |

| 2015-10-01 | 0.120333 | 0.076220 |

| 2015-11-01 | 0.216849 | 0.098576 |

| 2015-12-01 | 0.160359 | 0.085499 |

Invert the Transformation

df_forecast['Money_1d'] = (df['Money'].iloc[-nobs-1]-df['Money'].iloc[-nobs-2]) + df_forecast['Money'].cumsum()

df_forecast['MoneyForecast'] = df['Money'].iloc[-nobs-1] + df_forecast['Money_1d'].cumsum()

df_forecast['Spending_1d'] = (df['Spending'].iloc[-nobs-1]-df['Spending'].iloc[-nobs-2]) + df_forecast['Spending'].cumsum()

df_forecast['SpendingForecast'] = df['Spending'].iloc[-nobs-1] + df_forecast['Spending_1d'].cumsum()

df_forecast

| Money | Spending | Money_1d | MoneyForecast | Spending_1d | SpendingForecast | |

|---|---|---|---|---|---|---|

| 2015-01-01 | -11.050219 | 37.367991 | 67.549781 | 11737.649781 | 47.967991 | 12109.967991 |

| 2015-02-01 | -11.097937 | -4.699904 | 56.451845 | 11794.101626 | 43.268087 | 12153.236078 |

| 2015-03-01 | 1.242635 | -0.144623 | 57.694479 | 11851.796105 | 43.123464 | 12196.359542 |

| 2015-04-01 | -1.663244 | -0.442775 | 56.031235 | 11907.827340 | 42.680689 | 12239.040232 |

| 2015-05-01 | 0.991430 | 0.254518 | 57.022665 | 11964.850005 | 42.935207 | 12281.975439 |

| 2015-06-01 | -0.352719 | -0.038456 | 56.669946 | 12021.519951 | 42.896751 | 12324.872190 |

| 2015-07-01 | 0.480741 | 0.158538 | 57.150687 | 12078.670637 | 43.055290 | 12367.927480 |

| 2015-08-01 | 0.002947 | 0.048803 | 57.153633 | 12135.824271 | 43.104092 | 12411.031572 |

| 2015-09-01 | 0.284976 | 0.114297 | 57.438610 | 12193.262881 | 43.218389 | 12454.249961 |

| 2015-10-01 | 0.120333 | 0.076220 | 57.558942 | 12250.821823 | 43.294609 | 12497.544570 |

| 2015-11-01 | 0.216849 | 0.098576 | 57.775792 | 12308.597615 | 43.393185 | 12540.937754 |

| 2015-12-01 | 0.160359 | 0.085499 | 57.936150 | 12366.533765 | 43.478684 | 12584.416438 |

pd.concat([df.iloc[-12:], df_forecast[['MoneyForecast','SpendingForecast']]], axis=1)

| Money | Spending | MoneyForecast | SpendingForecast | |

|---|---|---|---|---|

| Date | ||||

| 2015-01-01 | 11733.2 | 12046.0 | 11737.649781 | 12109.967991 |

| 2015-02-01 | 11852.4 | 12082.4 | 11794.101626 | 12153.236078 |

| 2015-03-01 | 11868.8 | 12158.3 | 11851.796105 | 12196.359542 |

| 2015-04-01 | 11916.1 | 12193.8 | 11907.827340 | 12239.040232 |

| 2015-05-01 | 11947.6 | 12268.1 | 11964.850005 | 12281.975439 |

| 2015-06-01 | 11993.1 | 12308.3 | 12021.519951 | 12324.872190 |

| 2015-07-01 | 12045.3 | 12355.4 | 12078.670637 | 12367.927480 |

| 2015-08-01 | 12096.8 | 12394.0 | 12135.824271 | 12411.031572 |

| 2015-09-01 | 12153.8 | 12392.8 | 12193.262881 | 12454.249961 |

| 2015-10-01 | 12187.7 | 12416.1 | 12250.821823 | 12497.544570 |

| 2015-11-01 | 12277.4 | 12450.1 | 12308.597615 | 12540.937754 |

| 2015-12-01 | 12335.9 | 12469.1 | 12366.533765 | 12584.416438 |

Plots

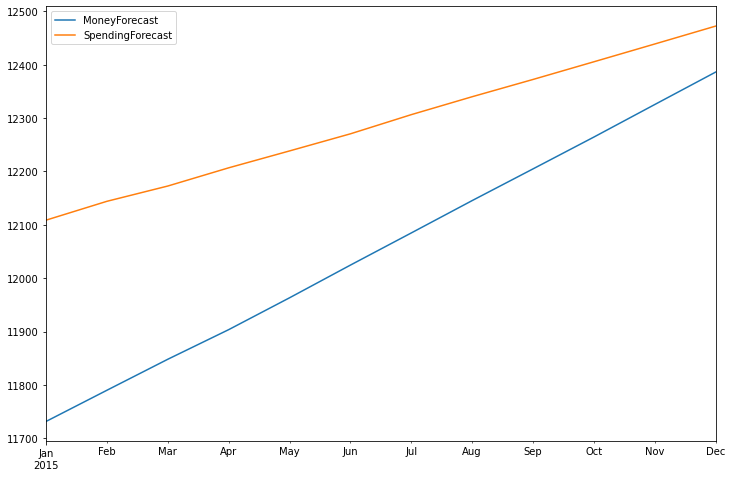

df['Money'][-nobs:].plot(figsize=(12,5), legend=True).autoscale(axis='x', tight=True)

df_forecast['MoneyForecast'].plot(legend=True)

<AxesSubplot:xlabel='Date'>